My husband was fired in 2015 after over 20 years of faithful work when I was one week away from having a baby. It is a long story but I will say that the person behind it makes me hope that karma is truly a bitch. My husband is completely fine with it and thinks it will be the best thing that ever happened to him. He's practically gleeful. I agree with Mr Monkey as it looks as though he's off to make three times as much money. But watch out for any woman you scorn, I'm ready to put my death laser eyes on ANYone who jeopardizes the safety of my family and mothers never forget this. Never. This person will be on the receiving end of my subconscious Kung fu ass kicking for the rest of their life. Having nightmares? Oh that was from me. Having a bad day where everything is going wrong? Also me. Suddenly broke out in pimples and your mental patient dog has mange? You're very welcome. The love of your life drove off a cliff in Mexico? Okay I wouldn't go that far, but you'll be wondering.

Okay, moving on and waving our hands in the air like we just don't care….. Me hold a grudge? Never. Our goal for 2016 is obviously to Buy Nothing and Sell Everything. However, we also are aiming to have twelve different sources of incomes. Here are some that we've already started.

1) I opened up an Etsy store. Surprisingly I made $100 my first week. It has also given me a chance to sell items directly from our farm and land which I love as it keeps me in nature.

2) Start contributing to our Roth IRAs again.

3) Start investing in Lending Club.

4) Continue our children's college contributions, but increase from $50 a month to $100 a month by the end of the year.

5) Sell items on Craigslist (so far we have sold a few thousand dollars worth of stuff, so we know this works).

6) eBay. So far this has been a dead end. I remember ten years ago, we made tons on eBay. What happened to it?

7) Salvage jobs. My husband has been finding salvage items (particularly old buildings) and finding ways to reclaim and sell it to other people. He's doing really great so far. It helps that he has a background in this already.

8) My husband works as an estimator contractor using his previous project manager skills. Sounds like he will start doing this very soon, in a few days actually. He's incredibly gifted - that's all I can say.

9) ibotta and other coupon apps. Surprisingly, I was able to get almost $30 back in three trips. It is not a lot but still free money.

10) Don't spend money. This may sound odd but I feel I must put it down. Shopping is practically a career for some women, er people. By not spending any dough, we will bank more of it.

11) Start our own entrepreneurial dream business. This will likely happen closer to the end of the year and this will be the enterprise that sets us up for retirement. My husband has opted to take a break from it for now but has his calm and faithful business partners waiting in the wings at any moment. It is also giving him an opportunity to see who truly has skin in the game and is in this for the long term, not immediate gratification. So far two people he thought were trustworthy have gone sideways on him. Better to weed them out now than find out later.

12) Open for the next dream…. Don't have a number twelve yet. What will it beeee?!

Other goals this Monkey year:

1) Pay off the HELOC. We borrowed this to renovate our cottage. We seriously underestimated how much it would cost to fix the little rock baby up. Even with us “doing it ourselves,” it still cost almost $40,000 over the span of three years. I will b talking about this in my “truths about homesteading series” at some point.

2) Pay off the two credit cards. I'm seriously embarrassed we have these debts. We go through phases in our life of paying them off and zeroing them down and then racking them back up again. I need to come back to this on a later date and explore this dysfunction in a very soul searching post.

3) My personal goal which I haven't discussed with my husband (oops) is to save ten percent of whatever we earn in investments. Whether that is our children's college education or our IRAS. We seem to be perpetually in debt and now with both of us in our 30s and 40s, it is time to start setting up our future retirement income. My goal is to one up a Vanguard 500 account (minimum needed is $1000) by the end of the year. It is not something he will oppose but the discussion needs to happen.

4) Lower our monthly costs. Rather now we need a minimum of $3000 to pay our monthly bills. That does not include gas or groceries. These are bills such as our mortgage, credit card payments, electric bill and so on. Our mortgage and debt is almost $1800 of that each month. The idea being that as we inch closer to retirement I the next Monkey year, our costs to sustain ourselves becomes more minimal.

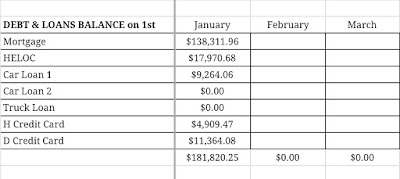

Here's our starting point for 2016. First spreadsheet shows our debt. The second shows our assets with our net worth at the bottom. The only real good thing we got going for us is we have more equity in our home than the average US citizen. But we are severely lacking in a source of retirement income. And while my husband and I supposedly will bring in $4500 in social security thanks to the lovely letter we get every year, I don't exactly trust in that 100%. The second thing we have going for us is we own all but one vehicle.

So that is where we begin for the year 2016. Cheers for us!

No comments:

Post a Comment